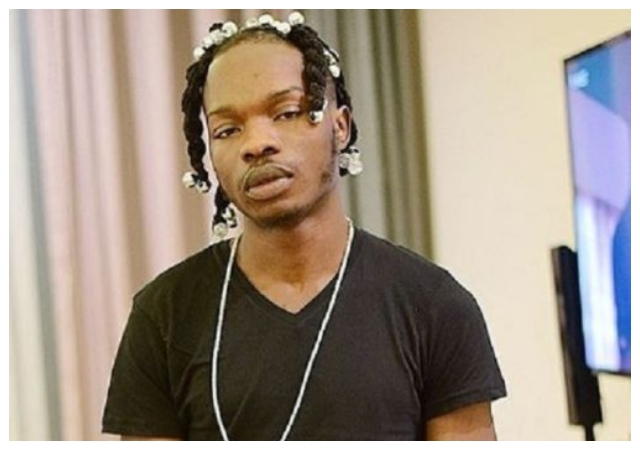

The trial of Nigerian musician Azeez Fashola, also known as Naira Marley, has been postponed by a Federal High Court located in Ikoyi, Lagos, due to accusations of online fraud.

The case was postponed by the court to March 6 and 7, 2024, so that the trial may continue.

The Economic and Financial Crimes Commission (EFCC) has charged Naira Marley on eleven counts pertaining to credit card fraud and conspiracy. He is currently awaiting trial on these counts.

One of the credit card numbers discovered on the singer’s smartphone had been reported by Visa, a platform for card payments, according to an EFCC statement released via X on Friday.

“The 10th prosecution witness (PW10) on Thursday, November 30, told Justice Nicholas Oweibo of the Federal High Court Ikoyi, Lagos how Visa, a card payment platform, flagged one of the credit card details found on a device belonging to the singer, due to fraudulent transactions,” the statement said.

Led in evidence by the prosecution counsel, Bilikisu Buhari, an investigator with the EFCC, Dein Whyte (PW10), said: “As part of the findings from the investigation, forensic analysis revealed that malicious programmes that are being used to illegally obtain credit card information, which can be used for card non-present transactions, were found on the device that was recovered from the defendant upon his arrest.”

Whyte also disclosed that “tools that are used to verify the validity, active state and accuracy of credit card credentials as well as the region of the issuer of that card were discovered on the defendant’s device. The analysis further revealed the website that had been accessed on the computer of the defendant through his browser history. The websites include sites where credit card information are illegally traded.”

He explained further that the phone and the laptop recovered from the defendant were both registered with his credentials, name and email address.

When asked by the prosecution counsel to state the result of his findings on the credit card details on the defendant’s device, Whyte responded, “With respect to the card details recovered from the device of the defendant, investigations revealed that he also exchanged those details with other persons.

“He further stated that one of the cards was reported to have been fraudulently used for a transaction by Visa,” the statement quoted Whyte as saying.

According to him, the card details that were in possession of the defendant’s device neither belonged to him nor were issued to him by any financial institution.

The statement added that “Under cross-examination by the defendant’s counsel, Olalekan Ojo, SAN, Whyte informed the court that a letter of investigation was written to Visa and that it confirmed that the card had been flagged for fraudulent transactions.

He, however, said that Visa didn’t link the credit card fraud to the defendant’s device “because the investigation was on the card and not on the device being used for the fraud.” He also stressed that Visa is a payment platform and not a telecommunication company.