- Leo DaSilva, expresses concerns about a company he supported financially.

- He attributes the company’s financial struggles to the economic downturn and naira depreciation under President Bola Tinubu.

- DaSilva describes the company’s situation as “generational debt” due to rising interest rates and poor economic policies.

Reality TV star and entrepreneur Leo DaSilva has voiced concerns over the financial struggles of a company he helped raise funds for, citing the economic downturn and naira depreciation under President Bola Tinubu’s administration as key factors.

In a post shared on his X (formerly Twitter) page, DaSilva revealed that the company has now fallen into what he described as “generational debt” due to rising interest rates and unfavorable economic policies. He noted that before Tinubu assumed office, the business operated under more stable financial conditions, but the naira’s sharp decline has significantly worsened its financial standing.

Comparing the business climate under former President Muhammadu Buhari to the current administration, DaSilva highlighted how inflation, high loan repayment rates, and the weakening currency have made it nearly impossible for many businesses to survive. He expressed concerns about the rising cost of goods and services, which has increased operational expenses and pushed companies deeper into debt.

His comments reflect the struggles of many Nigerian businesses currently grappling with economic instability. With a volatile exchange rate and increased borrowing costs, both small and large enterprises are finding it difficult to stay afloat.

As economic reforms continue under Tinubu’s leadership, business owners and investors are urging the government to implement policies that promote financial stability and support struggling businesses. DaSilva’s remarks add to the growing concerns about the challenges facing Nigeria’s economy today.

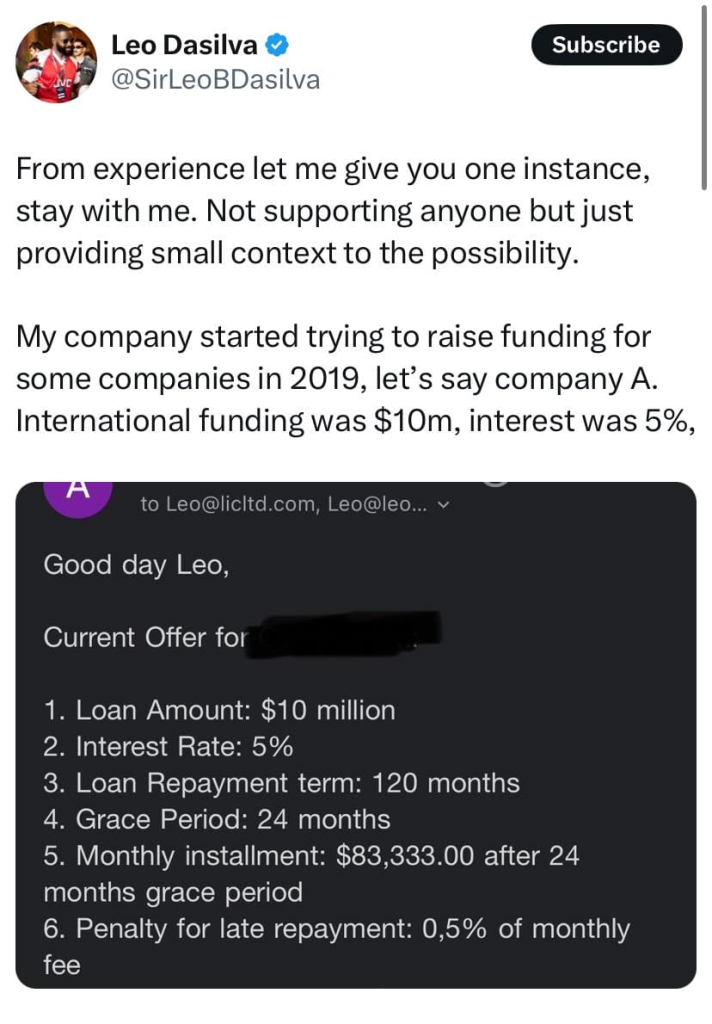

He tweeted;

From experience let me give you one instance, stay with me. Not supporting anyone but just providing small context to the possibility. My company started trying to raise funding for some companies in 2019, let’s say company A.

International funding was $10m, interest was 5%, its almost like suicide. This incident after we did audit was what made me remove my hand from raising money for Nigerian businesses. I might not understand all the Economics but I know business. If we do not export more things, Naira will be killing many businesses and in turn.

It will take magic for people in our generation with big ideas that need funding to actually get good loans.

I don’t even want to speak about what we have gone through with the former CBN admin but that’s gist for another day. So it’s possible to actually crack with that money.

Leave a Reply