Ibrahima Sory Sylla, the ambassador of Senegal to China, has criticized the World Bank and the International Monetary Fund (IMF) for their stringent lending policies toward countries in Africa.

The ambassador complained about the use of low ratings to assess the creditworthiness of African nations at a public event at Peking University, China, where he made this statement.

He declared, “The issue is that the ratings we are giving the African [countries] ought to be different. “

He emphasized that assessments from Fitch or Standard and Poor’s do not take local factors like food security into account. The IMF and World Bank, however, use these ratings as the basis for their assessments of economic sustainability.

He stated, “What we can understand is that so many [multilateral development banks] through the G20 [debt suspension initiative] said you have to go through this initiative, but when you [do so], they suddenly decided to downgrade your risk.”

“And the majority of developed, Western nations can exceed a debt-to-GDP ratio of 200 percent. They do not have a lower rating. “

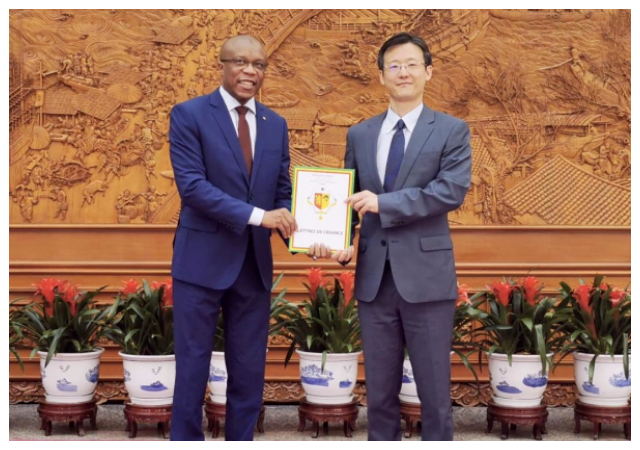

Jang Ping Thia, the lead economist at the Asian Infrastructure Investment Bank, also spoke at the event and stated that the IMF and World Bank believe their debt sustainability framework is workable.

He said, “My sincere belief is that IMF officials and World Bank officials are sincere in their belief that their debt sustainability framework works and works for the greater good.”

“The IMF chief at the desk frequently does their best to push the country’s financial boundaries,”

In recent years, many African nations have been forced to increase taxes and reduce subsidies due to unmanageable debts.

Ghana fell behind on its debt payments last year, and Kenya will be required to pay its $2 billion in Euro bonds in 2024.

A report from the IMF states that if the current trend continues, Sub-Sahara’s debt-to-GDP ratio could rise by another 10% by 2028. It has increased by 60 percent in the last ten years.